In India, gold is deeply rooted in both cultural and financial significance, representing wealth, tradition, and prosperity. Among the various gold bar sizes, the 10 tola gold bar holds a special place due to its convenient 10 tola gold bar price in india size and significant value, making it an attractive choice for Indian investors. But what determines the 10 tola gold bar price in India, and what factors should you consider when buying? Let’s explore the basics and key considerations for purchasing a 10 tola gold bar in India.

What is a 10 Tola Gold Bar?

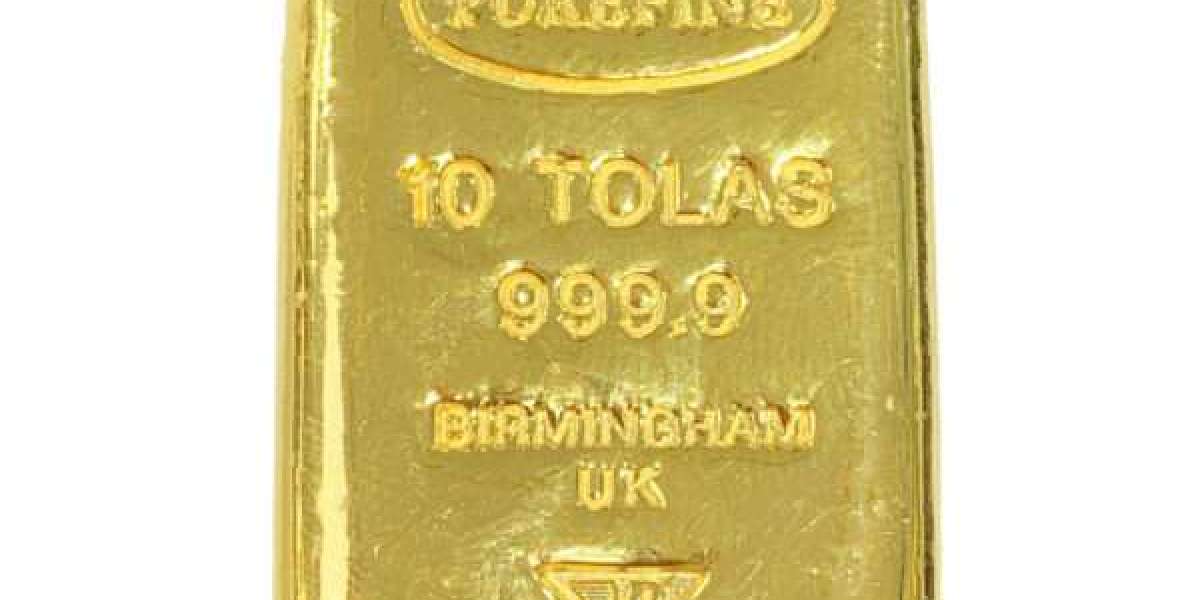

A tola is a traditional unit of mass commonly used in South Asia, especially in India, Pakistan, and Nepal, to measure gold. One tola is equivalent to approximately 11.66 grams, which means a 10 tola gold bar weighs about 116.6 grams. This size is popular for investors who want a valuable and manageable gold bar without committing to a larger 100-gram or 1-kilogram investment.

Calculating the Price of a 10 Tola Gold Bar in India

The price of a 10 tola gold bar in India is based on two primary factors:

Current Gold Rate per Gram: The price of gold fluctuates daily due to market conditions, global economic factors, and demand. The gold rate per gram provides the foundation for determining the 10 tola bar’s price. For example, if the current gold rate is ₹5,500 per gram, the base value of a 10 tola gold bar would be:

116.6 grams×5,500 (price per gram)=₹641,300116.6 \text{ grams} \times 5,500 \text{ (price per gram)} = ₹641,300116.6 grams×5,500 (price per gram)=₹641,300Premium Over Spot Price: The premium includes costs for refining, manufacturing, dealer markup, and certification. Larger bars, like the 10 tola, generally have lower premiums per gram than smaller items, making them more economical for bulk investments. Premiums vary by dealer, so it’s wise to compare prices from different sources.

If the premium on a 10 tola gold bar is around 2% over the spot price, the cost might increase to:

641,300×1.02=₹654,126641,300 \times 1.02 = ₹654,126641,300×1.02=₹654,126

Factors Affecting the 10 Tola Gold Bar Price in India

Several factors impact the daily price of gold and the premium for a 10 tola bar:

International Gold Prices: Global market trends heavily influence gold rates in India. The international spot price is affected by factors like economic conditions, inflation rates, and geopolitical events. A rise in global demand, especially from countries like China and the U.S., typically increases gold prices worldwide, including in India.

Currency Exchange Rate: The strength of the Indian Rupee (INR) against the U.S. Dollar (USD) plays a critical role in the cost of gold, as international gold prices are often quoted in USD. A weaker INR against the USD makes gold more expensive in India, while a stronger INR can lower the cost.

Indian Import Duties and Taxes: India is one of the world’s largest gold importers, and imported gold is subject to import duties and taxes. The Indian government imposes duties to curb excessive imports, affecting the final price of gold. Current duties and the Goods and Services Tax (GST) also influence the price per gram.

Supply and Demand Dynamics: Gold demand spikes in India during festive seasons, weddings, and other cultural events, as gold plays an integral part in celebrations. Increased demand can drive up prices, especially during peak seasons like Diwali and the wedding season.

Dealer Premiums: Different dealers charge varying premiums based on factors such as location, brand, purity, and market conditions. Buying from established dealers or certified brands like PAMP Suisse, Valcambi, or the Royal Mint may cost slightly more but ensures authenticity and purity.

Where to Buy a 10 Tola Gold Bar in India

When purchasing a 10 tola gold bar, choosing a reputable dealer is crucial to ensure you get genuine, certified gold. Here are some popular options:

Jewelry Stores: Many well-established jewelry stores sell 10 tola gold bars in addition to jewelry. Jewelers like Tanishq, Malabar Gold, and Kalyan Jewellers offer gold bars that come with purity certification and assay marks. Buying from a reputable jeweler can provide assurance of quality and purity.

Bullion Dealers: Specialized bullion dealers like MMTC-PAMP and RSBL (RiddiSiddhi Bullions Ltd.) offer a wide selection of gold bars and coins, including the 10 tola bar. These dealers often provide tamper-evident packaging, certificates, and lower premiums due to their focus on bullion.

Banks: Some banks in India, such as HDFC Bank, ICICI Bank, and Axis Bank, offer gold bars for sale, although this is typically limited to smaller weights. Bank-purchased gold often comes at a higher premium, as banks do not usually offer buyback services for gold.

Online Retailers: Many bullion retailers, such as CaratLane and Augmont, offer gold bars for online purchase, which are delivered directly to your home. Look for platforms with positive customer reviews, transparent pricing, and secure payment options to ensure a safe buying experience.

Tips for Buying a 10 Tola Gold Bar in India

To make a smart investment in a 10 tola gold bar, consider the following tips:

Compare Prices from Multiple Dealers: Prices vary between dealers, so take the time to compare. This will help you find a better deal and understand the range of premiums in the market.

Verify Purity and Certification: Ensure that the 10 tola bar you’re purchasing is certified as 24K (99.99% pure gold). Many reputable bars come with assay certificates and tamper-evident packaging, which helps with resale.

Choose a Reliable Dealer: Opt for well-established dealers with 10 tola gold bar price in india a history of positive reviews. Look for dealers affiliated with trusted organizations like the Indian Bullion and Jewellers Association (IBJA).

Check Buyback Policies: Some dealers offer buyback policies, which allow you to sell your gold bar back to them at a fair market price if you decide to liquidate your investment in the future.

Consider Safe Storage: Gold is a high-value asset, so secure storage is essential. Many investors choose bank lockers or third-party vaulting services for added security.

Selling a 10 Tola Gold Bar in India

When it’s time to sell your 10 tola gold bar, here are some things to keep in mind:

Monitor the Gold Rate: Gold prices fluctuate daily, so check the current gold rate and sell when the market is favorable. Many investors sell during peak demand periods, such as festivals, when prices are typically higher.

Find a Reliable Buyer: Jewelry stores, bullion dealers, and some banks may buy back gold bars. Selling to a reputable dealer ensures you get a fair market rate.

Verify the Buyback Price: Some dealers offer slightly lower buyback rates than the market price to account for processing fees. Compare rates from multiple buyers to get the best return.

Final Thoughts on the 10 Tola Gold Bar Price in India

A 10 tola gold bar offers a valuable investment option for those who want a significant amount of gold without the bulk of larger bars. Understanding the factors influencing the price, including the spot price of gold, currency rates, and local market demand, is essential for making an informed purchase. By choosing a reliable dealer, verifying certifications, and monitoring the market, you can confidently invest in a 10 tola gold bar to enhance your portfolio or safeguard wealth.